US Inflation Shock Zaps Yen, China CPI Up Next

Asia’s equity and bond markets are set to react to the U.S. inflation report, which had a significant impact on global markets. While U.S. inflation was slightly higher than expected, it led to a sharp decline in Fed rate cut expectations, a drop in stock prices, and a surge in bond yields and the dollar.

The strengthening of the dollar and the increase in Treasury yields will have a tightening effect on financial conditions for both corporate and sovereign borrowers in emerging markets, including Asia. This will put pressure on Asian markets when they open on Thursday.

ALSO READ: Global Venture Funding Drops 30% as China Helps Drag Market Down

One notable development for Asian markets is the Japanese yen’s decline to a 34-year low against the dollar. Additionally, the yen also reached its weakest level in over 30 years against the Chinese yuan. Currency traders will closely monitor any potential intervention from Japanese authorities to stabilize the yen, although the rise in the dollar/yen exchange rate is primarily driven by increasing U.S. yields and widening U.S.-Japan yield spreads.

On the other hand, Chinese authorities may not be pleased with Japan gaining a competitive advantage over China due to the bilateral exchange rate. Furthermore, Beijing will likely be unhappy with Fitch’s decision to lower China’s sovereign credit rating outlook to negative. Fitch also revised its growth forecasts for China downward while raising its projections for debt and deficits.

In more negative news for China’s ratings, S&P Global downgraded developer China Vanke’s credit rating to junk status, dealing another blow to the already struggling property sector. S&P lowered the rating of China’s second-largest developer by sales by three notches to BB+ from BBB+.

On the geopolitical front, U.S. President Joe Biden and Japanese Prime Minister Fumio Kishida highlighted increased joint military cooperation and a new missile defense system, presenting a unified stance against China and Russia.

Investors will shift their focus to China on Thursday, as Beijing is set to unveil producer and consumer price inflation data for March.

Factory gate prices have been experiencing deflation since October 2022 on a year-on-year basis, while annual consumer price inflation has remained mostly negative for nearly a year.

Projections suggest the annual PPI rate may have dropped to -2.8% from -2.7%, and annual CPI inflation may have eased to 0.54% from 0.7%, with consumer prices expected to have decreased by 0.5% on a monthly basis.

These figures, if accurate, indicate that deflationary pressures continue to weigh heavily on the Chinese economy, signaling either excess capacity or subdued demand, or possibly both.

Key developments to watch on Thursday include:

– China producer price inflation (March)

– China consumer price inflation (March)

– Philippines trade data (February).

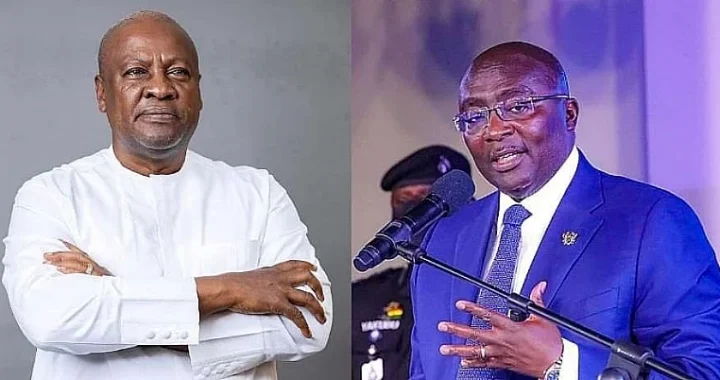

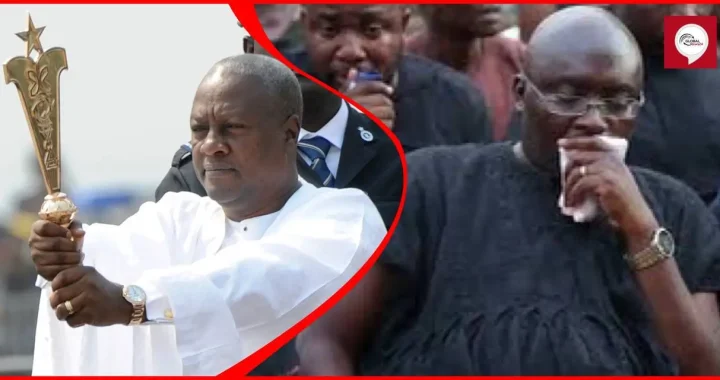

2024 Election Live Results: Former President Mahama Wins Election; Dr. Bawumia Concedes Defeat

2024 Election Live Results: Former President Mahama Wins Election; Dr. Bawumia Concedes Defeat  2024 Election Live Results: John Dumelo In Comfortable LEAD As Mahama Projected To Win

2024 Election Live Results: John Dumelo In Comfortable LEAD As Mahama Projected To Win  2024 Election Live Results: Provisional Results So Far; 5 Parliamentary Projections Declared

2024 Election Live Results: Provisional Results So Far; 5 Parliamentary Projections Declared  Election 2024: John Mahama Predicted To Win With 52.2%, Bawumia Trails With 41.4% – Full Report

Election 2024: John Mahama Predicted To Win With 52.2%, Bawumia Trails With 41.4% – Full Report  2024 Election in Ghana: Symbolic Meaning of NDC’s No. 8 on the Ballot Paper

2024 Election in Ghana: Symbolic Meaning of NDC’s No. 8 on the Ballot Paper  It is POSSIBLE NPP will lose the 2024 Election

It is POSSIBLE NPP will lose the 2024 Election  Accurate Football Predictions For Today, Saturday 8th March 2025

Accurate Football Predictions For Today, Saturday 8th March 2025  Champions League Predicted Correct Scores For Today, 5th March 2025

Champions League Predicted Correct Scores For Today, 5th March 2025